pay utah corporate tax online

To look up local sales tax rates including Salt Lake City by address and zip. TOPICS CREDITS ADDITIONS ETC.

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

A C corporation filing form TC-20 may be entitled to carry back a current-year loss against income of the previous three years.

. LLCs operating in Utah that elect for taxation as corporations are responsible for paying this. Rememberyou can file early then pay any amount you owe by this years due date. That rate could include a combination of state county city and district tax rates.

Filing Paying Your Taxes. For security reasons our e-services TAP OSBR etc are not available in most countries outside the United States. Running a small business can be so much fun but you do have to pay your Utah small business taxes.

January 1 2018 Current. Complete and sign this application and submit it to the Tax Commission at the address below. You will need your property serial number s.

This means you should be charging Utah customers the sales tax rate for where your business is located. Acceptable forms of payment via mail are check cashiers check or money order. Online payments may include a service fee.

Property Tax Payment Information. Payment Types Accepted Online. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT. You can also pay online and avoid the hassles of mailing in a check. 1116 Payment Coupon Penalties and Interest Use payment coupon TC-559 to make the following corporatepartnership tax payments.

The state sales tax rate is 485. Please contact us at 801-297-2200 or taxmasterutahgov for more information. TAP includes many free services such as tax filing and payment and the ability to manage your account online.

This website is for those entities who wish to register online but do not need a number from a Utah State Government Agency such as a Tax Number. You may also mail your check or money order payable to the Utah State Tax Commission with your return. There is no fee when paying by e-check through the online system.

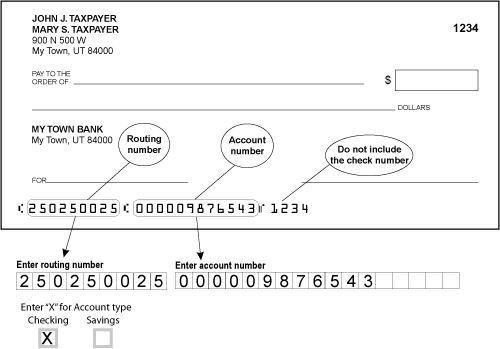

To claim a refund from a Utah net operating loss carryback the corporation must file form TC-20L Utah Application for a Refund from a Corporation Loss Carryback. Go to Taxpayer Access Point and create a TAP login to file and pay your Utah business taxes. Your bank may request the following information in order to process an e-check debit payment request.

See Utah Income Tax Penalties and Interest. See also Payment Agreement Request. It does not contain all tax laws or rules.

What you need to pay online. You may be subject to penalties and interest if you do not file your return on time or do not pay all income tax due by the due date. You may pay your tax online with your credit card or with an electronic check ACH debit.

INSTRUCTIONS LINE-BY-LINE INFO. Like nearly every other state Utah requires corporations to pay a corporate income tax which is also referred to as the corporation franchise and income tax. Company Identification Company name Utah 14-digit tax account number Tax Type.

Property Tax payments may be sent via the US Postal Service to the Treasurers Office. Utah is an origin-based sales tax state. TAP should be available on Saturday March 12th at 8am MDT.

Please note that our offices will be closed November 25 and November 26 2021 for the Thanksgiving Holiday Pay over the phone by calling 801-980-3620 Option 1 for real property. For security reasons TAP and other e-services are not available in most countries outside the United States. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

Similar to the personal income tax businesses must file a yearly tax return and are. Utahs corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Utah. The Utah corporate income tax is the business equivalent of the Utah personal income tax and is based on a bracketed tax system.

Utah State Tax Commission Clear form CorporatePartnership Payment Coupon Print Form TC-559 Rev. Utah does not require quarterly estimated tax payments. Taxpayer Access Point Downtime Notice.

January 1 2008 December 31 2017. Requisition to Make Utah Tax Payments Through EFT ACH Credit taxutahgov Taxpayers who make Utah tax payments using EFT ACH Credit must follow the terms and conditions set forth below. The minimum tax if 100.

The corporate income tax in Utah is generally a flat rate of 5 percent of the taxable income of the business. It could have been better. Payments must be postmarked by November 30 th to avoid penalties unless the 30 th occurs on the weekend.

Taxpayer Access Point TAP Register your. File electronically using Taxpayer Access Point at taputahgov. How was your experience with papergov.

If you do not have these please request a duplicate tax notice here. The loss carryback is subject to a 1000000 limitation. Payments can be made online by e-check ACH debit at taputahgov.

TAP will be down for maintenance starting Friday March 11th at 5pm MDT. You can prepay at any time at taputahgov or by mailing your payment with form TC-546 Individual Income Tax Prepayment Coupon. What You Need To Pay Online.

If you have questions about your property tax bill or want to make a payment see this document. 1 Estimated tax payments 2 Extension payments 3 Return payments Mark the circle on the coupon that shows the type of payment you are making. WHATS NEW RECENT INFORMATION.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. If a credit card is used as the method of. Corporation Estimated Tax Requirements Every corporation with a tax liability of 3000 or more in the current or.

For your protection do not send cash through the mail. If your tax payments do not equal the lesser of 90 percent of the current-year tax liability 100 minimum tax for. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers.

Pay for your Utah County Real Property tax Personal Property tax online using this service. Here is a guide on how that process works. Use payment coupon TC-559 to make the following corporatepartnership tax payments.

Follow the instructions at taputahgov. The Doing Business As DBA Online Registration was created to allow existing business entities and individuals who wish to transact business under an assumed name DBA. FILING PAYING YOUR TAXES.

To pay Real Property Taxes. Utah has a single tax rate for all income levels as follows. In case you missed it the link opens in a new tab of your browser.

Utah Png 1600 4026 Utah Eclos Cost Saving

Guided Utah Hiking Trips Tours Utah Hiking Guides Wildland Trekking Hiking Trip Hiking Vacations Usa Hiking Vacation

What Is A Mortgage Loan Mortgage Loans Mortgage Home Mortgage

Utah Deal Diva Helping Utah Families Live On Less Discount Lagoon Tickets Lagoon Good Times Fun

Stock Assignment Paper Issued By Whitney Company Of Salt Lake City Utah Old Stock Certificate Royal Uranium Corporat Assignments Salt Lake City Utah Whitney

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

Utah Income Taxes Utah State Tax Commission

I Made Some If You Like Hillary Sharables For Facebook What Do You Think Learn Spanish Online Free Spanish Lessons Learning Spanish

Utah State Tax Benefits Information

Tax Offices In Utah Tax Help Utah Internal Revenue Service

Seniors Are The Targets Of Scams Utah Is Not Alone Online Accounting Scammers How To Protect Yourself

Diy Accounting Errors Mistakes That Can Put Your Business At Risk Accounting Financial Management Business

Utah State Tax Commission Official Website

Sales Tax Token Utah Emergency Relief Fund And Utah Sales Tax Commission Token Token Etsy Sales Tax

If You Are Looking For Home Loans Broker Then You Can Go For Wedohomeloansforyou We Are Home Loan Specialists Mortgage Loans Refinance Mortgage Home Mortgage

State Corporate Income Tax Rates And Brackets Tax Foundation

Composition Of State And Local Tax Rev Income Tax Government Taxes Revenue